Simple and Compound Interest: More Than What It Seems | Part 1

Discover how simple and compound interest works in greater detail. Learn how the formulas are true based on mathematical proofs.

What everyone knows is how the basics of simple and compound interest works, but do they know exactly why it works, and the fundamental concepts behind its functionality? In this post, we dive into the theories and intricacies that lie within interest which will be split into two articles.

The Time Value of Money

Here’s a starter question:

Would you like to receive RM1,000 now, or RM1,000 1 year later?

At face value, it looks like you are receiving the same amount of money, so the apparent answer is that both should be the same, right? However, if you chose the former, you have made the correct decision. Why does receiving RM 1,000 now provide more value now than in the future?

This is called the Time Value of Money (TVM), and it is the basis of every decision-making in business and financial accounting. There are 3 reasons why this exist:

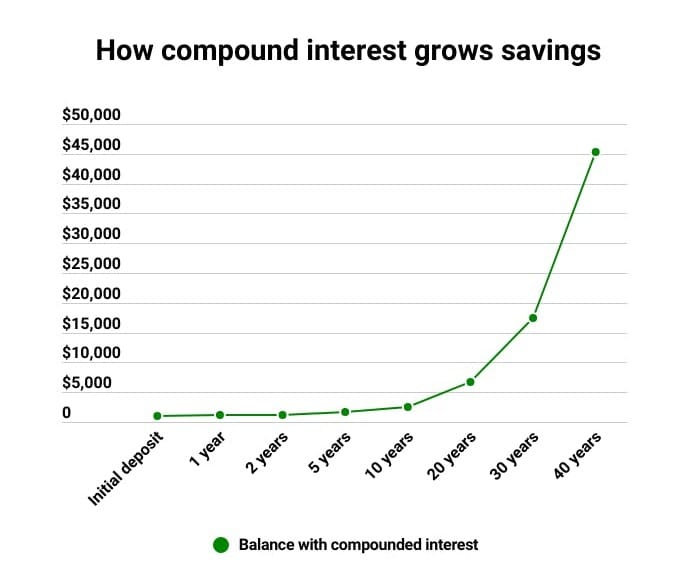

- Opportunity cost:

The money received now can be saved and invested on financial assets with interest, therefore resulting in more money in the future. - Inflation:

- Figure 1.1 shows the consumer price index of Malaysia, from 2013 to 2023, measured using index points. When there is an increase in CPI, it means that there has been an increase in changes of prices over time. This eventually leads to an increase in cost of living and income (presumably because income needs to match the rate of increase in cost of living). This process is called indexation.

- With this information, we can deduce that, if you have RM100 in Malaysia in 2013 (present value), your purchasing power (number of items you can buy) is significantly higher than if you have RM100 in 2023 (future value). You can better understand this concept through the lens of a common analogy that most of us have heard from our parents. Back in the day, the cost of a pack of nasi lemak (a common malaysian cuisine) with a drink was around RM1 at its maximum. However, in today's standards, the same would costs RM4 at the bare minimum, resembling a 400% increase.

3. Uncertainty:

Until the money is physically in your hand, there is always a risk of it being a default. Default means that the borrower has failed to make payment as agreed, or they have failed to meet the covenants (terms and conditions) of the lending agreement.

The importance of TVM is emphasized when we are deciding a more favorable interest rate, when all other factors are constant. Consider an investment that is delayed by one or two years. Over time, the relative negative impact is significant. (Note: significant and large have two different meanings in accounting. Large means that the implications of the negative impact brings about severe consequences on you, whereas significant just means that it is noticeable, but not to the point of high severity.)

Simple interest is commonly used for automobile loans or short term personal loans. In the US, most mortgages with amortization schedules also use simple interest, although it may feel like compound interest. Amortization is an accounting method used to lower the book value of a loan or an intangible asset over a period of time to comply with the matching principle stated in the GAAP. The calculation for simple interest is rather straightforward due to the fact that it uses principal only.

This article will only look at simple interest first. Although it may seem easy, there are many financial technicalities and equations; as such, simple interest deserve its own article.

Simple Interest

To better illustrate the concept of simple interest, I will present you with a simple example.

Let's say that you invest RM1,000 with an interest rate of 10% per annum (p.a.) for 5 years. The table below, therefore, shows the details of the investment:

Now, let’s define some common terminologies:

- Initial principal, $P_{0}$ : Value of investment, or present value, at year 0 ($y_{0}$).

- Total number of interest periods, $n$: Number of times when interest is calculated across $n$ years.

- Future value, $P_{n}$ : The future value of $P_{0}$ after the $n$ th year.

- Number of interest periods per year, $m$: Number of times when interest is calculated per year.

- Nominal rate/Quoted rate/Stated rate, $i^{m}$ : The annual interest rate, expressed as a decimal.

- Interest rate per interest period, i: $$i=\frac{i^{m}}{m}$$

For example, if the interest rate is $4% $ calculated $4$ times per year, then $m=4$ and $i(4) = 0.12$, therefore $i=\frac{{0.12}}{4}=0.03$, which is the interest rate per interest period.

If we were to tabulate this over $5$ years, it will look something like this:

At the end of the first interest period where $n=1$, we received $iP_{0}$ in interest. So the future value of $P_{0}$ after the period is:

$$P_{1} = P_{0} +iP_{0}=P_{0} (1+i)$$

At the end of the second period where $n=2$, we will get the following equation:

$$P_{2} =P_{1} +iP_{0}=P_{0} (1+i) +iP_{0}=P_{0} (1+2i)$$

At the end of the 3rd period where $n=3$, we will get the following equation:

$$P_{3} =P_{2} +iP_{0}=P_{0} (1+2i) +iP_{0}=P_{0} (1+3i)$$

From this, we can see a pattern, which in turn suggests the following theorem,

Theorem 1.1

If we start with $P_{0}$ , and invest for $n$ interest periods at an interest rate of $i^{m}$ (expressed as a decimal), calculated $m$ times per year using simple interest, $P_{n}$, the future value of $P_{0}$ , at the end of $n$ interest periods will be:

$$P_{n}=P_{0} (1+ni)$$

where $i=\frac{i^{m}}{m}$.

We can prove this using two methods: mathematical induction and recurrence relation.

Mathematical Induction

Base case: $n=1$ is true.

Since we have the above already proven, we will move on to the inductive step.

Inductive step:

Assume that $n=k$ is true, that is $P_{k}=P_{0}(1+ki)$.

If $n=k$ is true, then $n=k+1$ must also be true.

$P_{k+1}$ is the total amount of money (principal and total interest) at the end of the period $k+1$. We can also say that $P_{k+1}$ is the sum of $P_{k}$ , the amount of money at the beginning of the period $k+1$, and $iP_{0}$ is the interest earned during the period.

$P_{k+1} =P_{k} +iP_{0}$

$P_{k+1} =P_{0} (1+ki)+iP_{0}$

$P_{k+1} = P_{0} (1+(k+1)i)$

which is in the form of $P_{n} = P_{0} (1+ni)$ where $n=k+1$.

Therefore, $P_{n} =P_{0} (1+ni)$ for all values of $n$ for which $n$ is a real positive integer.

Proof by Recurrence Relations

We know that $P_{k+1}=P_{k} +iP_{0}$ , so if we were to sum this from $k=0$ to $k=n-1$, we will have:

$\sum_{k=0}^{n-1}P_{k+1}=\sum_{k=0} ^ {n-1}P_{k} + \sum_{k=0} ^ {n-1}iP_{0}$

$P_{1}+P_{2}+P_{3}...+P_{(n-2)+1}+P_{(n-1)+1}=P_{0}+P_{1}+P_{2}...+P_{n-2}+P_{n-1} + \sum_{k=0}^{n-1}iP_{0}$

If we were to "cut" all like terms, we will get the following equation:

$P_{n}=P_{0}+\sum_{k=0}^{n-1}iP_{0}$

$P_{n}=P_{0}(1+ni)$, and the formula is proven.

Analysis of the Future Value of RM1.00

- The quantity $P_{n}−P_{0}$ is the principal appreciation (increase in value of your principal). Notice that in the case of simple interest, $P_{n}−P_{0}= P_{0}(ni)$, that is, $P_{n}−P_{0}$ is directly proportional to $P_{0}$, $n$, and $i$, so doubling any of them doubles the principal appreciation.

Referring to Figure 1.2, if we look at $n = 20$, we see that the vertical distance from the future value at $10%$ (RM3) to the present value (RM1) is twice the distance from the future value at $5%$ (RM2) to the present value (RM1). - The quantity $\frac{P_{n} − P_{0}}{P_{0}}$ is called the rate of return. Notice that in the case of simple interest we have $\frac{P_{n} − P_{0}}{P_{0}}=ni$ , so doubling either $n$ (the number of interest periods) or $i$ (the interest rate per period) doubles the rate of return.

- The quantity $\frac{P_{n} − P_{0}}{nP_{0}}$ is the rate of return per period. In the case of simple interest, we have $\frac{P_{n} − P_{0}}{nP_{0}}=i$, so the simple interest rate per interest period is the rate of return per period.

- Equation $1.1$ is valid for $n ≥ 0$. But what happens when $n < 0$? In other words, if we accumulate $P_{0}$ over the past $n$ years at a simple interest rate of $i$ per year, then what amount, which we call $P_{−n}$, did we start with $n$ years ago?

Referring to theorem $1.1$, we thus have :

$P_{0}=P_{−n}(1 + ni)$ so,

$ P_{−n}$=$P_{0}$$\frac{1}{(1 + ni)}$ (Let's call this theorem $1.2$)

Now, if you look carefully, theorem $1.1$ is then not equal to $1.2$ with $n$ replaced by $−n$.

Proof:

If we use theorem $1.1$ and sub $n$ with $-n$, we would then get:

$P_{n}=P_{0}(1+ni)$

$P_{-n}=P_{0}(1-ni)$ (Equation $1$)

But, if we were to reverse this, meaning that $P_{0}=P_{-n}$, and that $P_{n}=P_{0}$, we would get:

$P_{n}=P_{0}(1+ni)$

$P_{0}=P_{-n}(1+ni)$

$P_{-n}=\frac{P_{0}}{1+ni}$ (Equation $2$)

Since Equation $2$ is not, by definition, equivalent to Equation $1$, thus theorem $1.1$ is valid only for $n ≥ 0$.

The next article will delve deeper into compound interest, providing a comprehensive level of detail. It will include additional graphs, mathematical explanations, and theoretical concepts.

References

- Cote, C. (2022). Time Value of Money (TVM): A Primer | HBS Online. [online] Business Insights Blog. Available at: https://online.hbs.edu/blog/post/time-value-of-money

- Lovelock, D., Mendel, M. and A. Larry Wright (2007). An Introduction to the Mathematics of Money. Springer Link. doi:https://doi.org/10.1007/978-0-387-68111-5.

- Niesen, J. (2012). MATH1510 Financial Mathematics I. [online] Available at: http://www1.maths.leeds.ac.uk/~jitse/math1510/notes-all.pdf

- openstax.org. (n.d.). 7.4 Applications of TVM in Finance - Principles of Finance | OpenStax. [online] Available at: https://openstax.org/books/principles-finance/pages/7-4-applications-of-tvm-in-finance

- Shah, S. (2021). Is the Consumer Price Index (CPI) the best measure of inflation? [online] Investopedia. Available at: https://www.investopedia.com/ask/answers/012115/consumer-price-index-cpi-best-measure-inflation.asp#:~:text=When%20there%20is%20an%20upward

- Tradingeconomics.com. (2019). Malaysia Consumer Price Index. [online] Available at: https://tradingeconomics.com/malaysia/consumer-price-index-cpi

- Vaidya, D. (2017). Time Value of Money (TVM) - Definition, Concepts & Examples. [online] WallStreetMojo. Available at: https://www.wallstreetmojo.com/time-value-money/